Arne Theisen from JTL has written a great article on his blog about Google Shopping, which I can really recommend everyone to read here. The question that came up for me when reading the article was, which products are my bums and bums and how do I find this out?

I once refreshed my business knowledge with the help of books and Google. In the process, I came across good old cost/performance accounting and, as part of it, contribution margin accounting, with the help of which and the data from JTL-Wawi I want to approach the problem.

Definition and goals

In cost and activity accounting, the contribution margin is the difference between the revenues generated (sales) and the variable costs. It is therefore the amount available to cover fixed costs. The contribution margin can be related to the total quantity (=DB) of a product as well as to a unit of measure (=db) (unit size) Source Wikipedia

Entrepreneurs often give higher importance to sales targets. But it may well be that sales are eaten up by rising costs, so to speak, and the bottom line is a negative operating result. The contribution margin helps to concretize the operating goals. For example, a company wants to make €1 million in sales with a contribution margin of €500,000 through its online store or a major customer. This means that the contribution margin should be related to certain parameters:

- Products and product groups

- Customers and customer groups

- Marketplaces and regions

Fixed costs and variable costs

The separation of costs into fixed costs and variable costs is not always clearly feasible in practice. On the one hand, there are costs that vary monthly and yet cannot be clearly assigned to a product. On the one hand, there are fixed costs that may very well be allocated proportionately to the products. In retail, I consider variable costs to include the purchase price, the cost of procurement, commissions for marketing and the cost of shipping, unless these are passed on to the customer.

Note: The statistics management of JTL-Wawi is to be used here from my point of view unfortunately only as a thumb * Pi estimate analysis. If a seller sends the goods free of shipping costs to the customer from a certain amount, there are still variable costs in the form of shipping costs, which are not taken into account in the so-called profit statistics of JTL-Wawi.

For the analysis of bums and sellers, this error in the system can be ignored for the time being, since here we are only interested in which products have the largest share in the coverage of fixed costs in a certain period.

- Fixed costs: All costs incurred by the company even without the sale of a product. These include wages and salaries, rent, communication costs (Internet and telephone), IT costs, consulting costs, office supplies, advertising, etc. (I include advertising in the fixed costs because it is not possible to clearly determine whether it has an influence on other products. Advertising also includes Google Adsense or Google Shopping campaigns).

- Variable costs: All costs that can be directly allocated to a product or a material group. These include the direct and indirect costs of procurement as well as direct selling costs such as commissions and shipping.

Contribution margin accounting as unit accounting

The purpose of contribution margin accounting as unit accounting is to determine the cost price. This is lowest price at which a product should be sold. The formula for this is simple:

Sales revenue – variable costs = gross profit = contribution margin

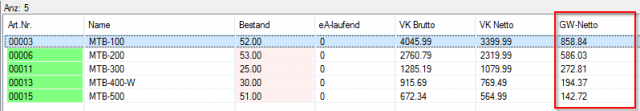

In JTL-Wawi this column is called GW-Netto in the list view of the product management and here the difference between net sales price and Ø net purchase price is displayed.

This value can/could now be evaluated as contribution margin per unit (=db).

Caution: GW-Netto is by no means the net profit you make when selling an item!

Contribution margin accounting as accrual accounting

Unfortunately, contribution margin accounting as accrual accounting is no longer quite so simple. In principle, the formula is the same, i.e. revenues of a period minus the variable costs of the period results in the contribution margin. That would be feasible if you only had one product in your portfolio. In practice, however, it looks like you as an online retailer sometimes have several thousand products in your assortment and you want to know which products are worthwhile and which you can safely take out again.

The following table provides a breakdown of sales by product group and product:

| Product group A | Product group B | Product group C | Total | ||||

| Product 1 | Product 2 | Product 3 | Product 4 | Product 5 | Product 6 | ||

| Revenue/Sales | 6000 | 5000 | 4000 | 3000 | 2000 | 1000 | 21000 |

| – variable costs | 2000 | 1600 | 1300 | 1000 | 600 | 300 | 6800 |

| Contribution margin | 4000 | 3400 | 2700 | 2000 | 1400 | 700 | 14200 |

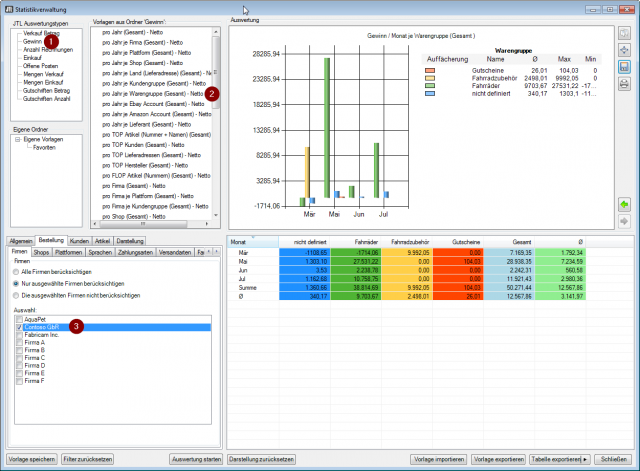

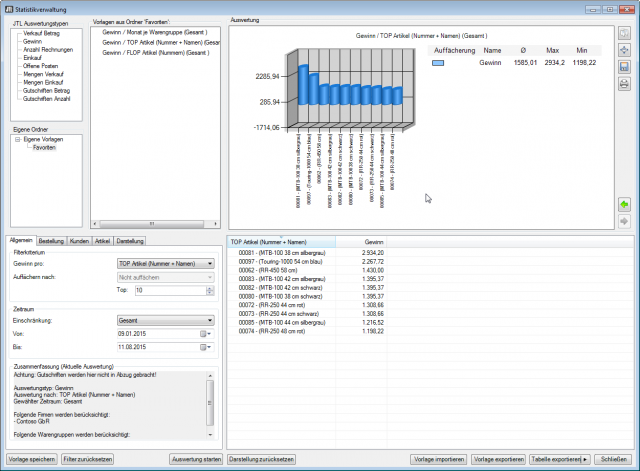

In order to get an overview of which product group contributes which contribution margin, select Profit (1) (better known as contribution margin) under Evaluation types and “per year per product group (total) -Net” (2) under Templates. Under General I still selected Profit per month under Filter criterion and in the Order tab I limited the selection to the company Contoso GbR. After that I got the diagram in the screenshot.

You now know the contribution margin per material group. When there are several hundred or thousand products, determining the contribution margin per product may not make sense. In the next step I would determine the top 10 and flop 10 products per commodity group and your contribution margin.

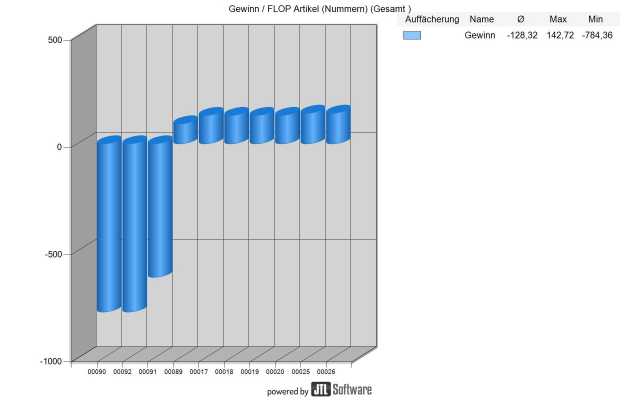

Again, JTL-Wawi will not give you the profit per item but only the contribution margin. I have limited the default template here to a company and a specific merchandise group and saved it as a new template in the custom template folder. Using this simple evaluation in JTL-Wawi, I now know the top 10 products from the product group bicycles that have generated the highest contribution margin in the specified time period (period). Proceed in the same way to determine the 10 flop articles for a product group, except that you select FLOP articles (numbers) as a template here.

Conclusion

With contribution margin accounting as period accounting, you get an overview of which products/articles contribute which amount to the coverage of fixed costs. The higher the contribution margin, the more successfully you market a product. Despite the weaknesses I found during my research on this topic, the statistics management in JTL-Wawi is quite capable of providing a first rough overview to the entrepreneur. From my point of view, the variable costs in JTL-Wawi need to be mapped even better here and the misleading naming of the profit statistics needs to be revised.

The contribution margin as a unit calculation is best suited for determining the cost price. If you have determined your flop articles via the statistics management, you have here a basis for the pricing of the sale of these articles to plan without getting a negative contribution margin.

To determine which marketplaces are worthwhile, a contribution margin calculation broken down by them is the first point of reference. So I find out which marketplaces are doing well and need less attention, and which need a little more attention and therefore probably advertising budget. In the second step, I can use the top article profit statistics to determine my top sellers per marketplace. You determine the bums per marketplace with the flop article profit statistics. The slow sellers, i.e. the articles that are not sold at all and therefore do not generate any contribution margin, can be determined via the statistics in Quantities Sales.

Do you have questions or need an individual offer? Do not hesitate to contact us.

- 0/5

- 0 ratings

| Very bad! | Bad | Hmmm | Oke | Good! |

|---|---|---|---|---|

| 0% | 0% | 0% | 0% | 0% |

Haben Sie Fragen oder brauchen ein individuelles Angebot? Zögern Sie nicht, uns zu kontaktieren.