In this article I show how to set up a company in Switzerland in JTL-Wawi correctly including the centime rounding.

Set up company in Switzerland

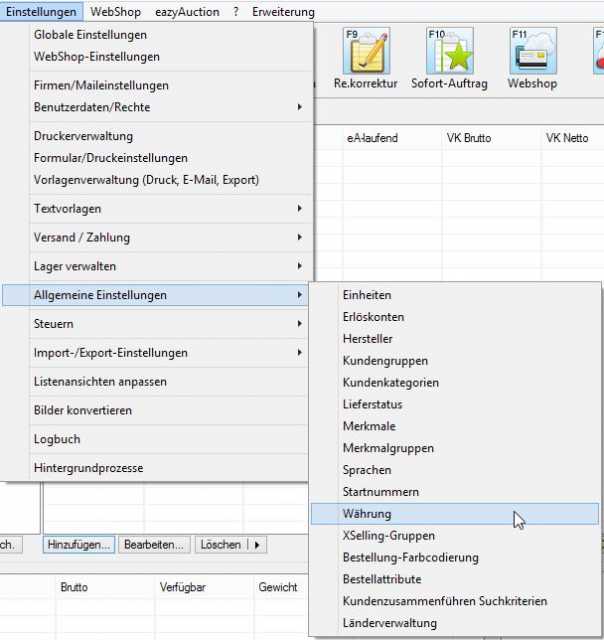

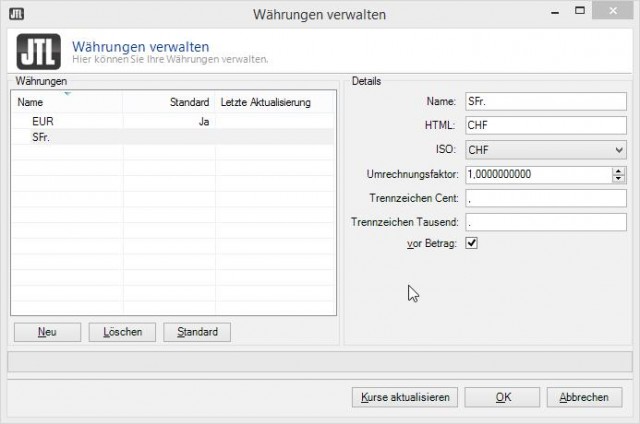

First, we adjust the currency settings in JTL-Wawi and set the Swiss franc as the default currency. To do this, we open the currency management via Settings → General settings → Currency.

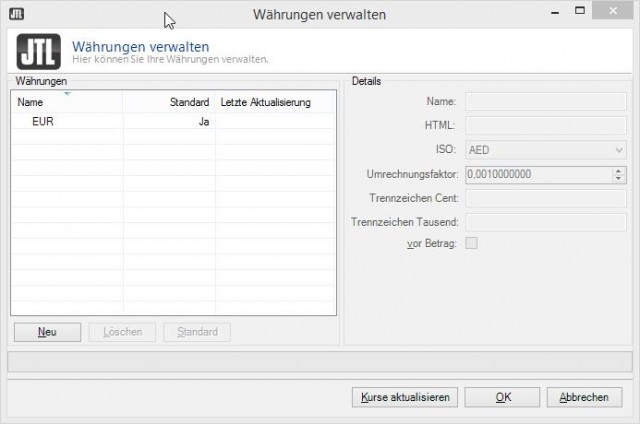

In the Manage Currencies window we click on “New”.

In the Details section we fill in the details as shown in the screenshot on the right:

Name: SFr.

HTML: CHF

ISO: CHF

As separator thousand the point can still be deposited and “before amount” can be activated.

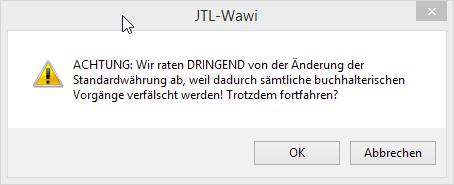

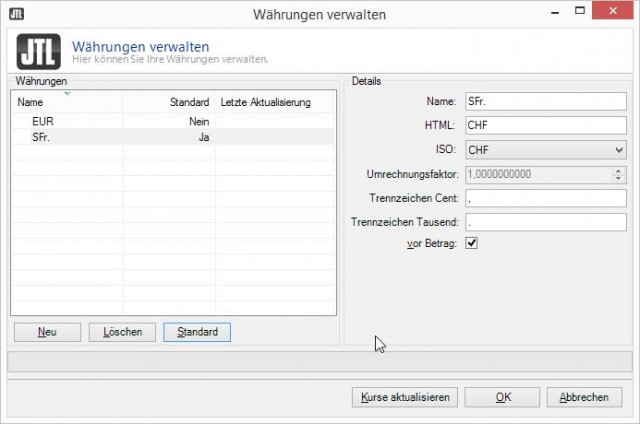

Then we click the “Standard” button.

A message box appears, informing us that all accounting transactions will be falsified! We confirm this window by clicking the “OK” button.

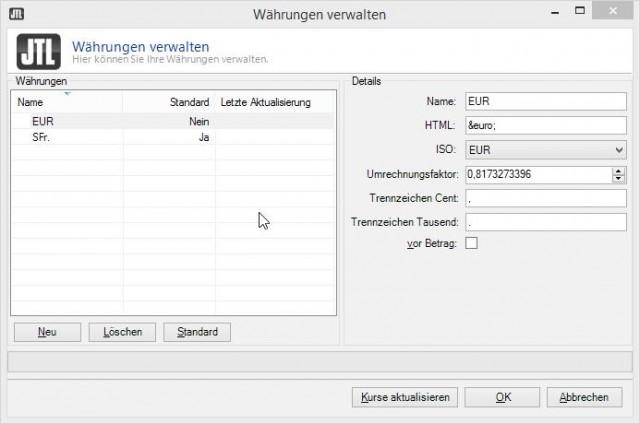

Now we click on the button “Update exchange rates” to have the current exchange rate to the Euro.

By clicking on “OK” we can close the “Manage currencies” window again.

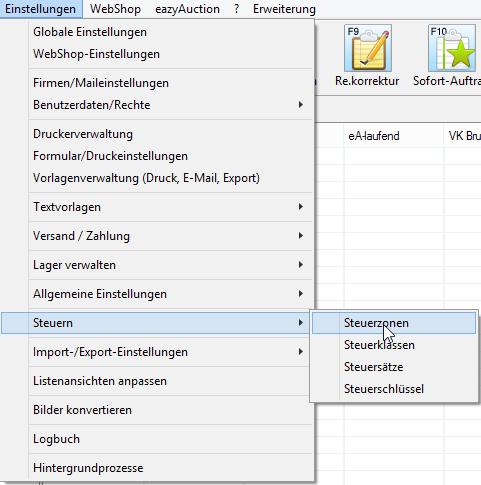

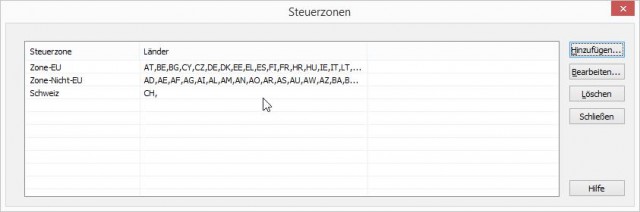

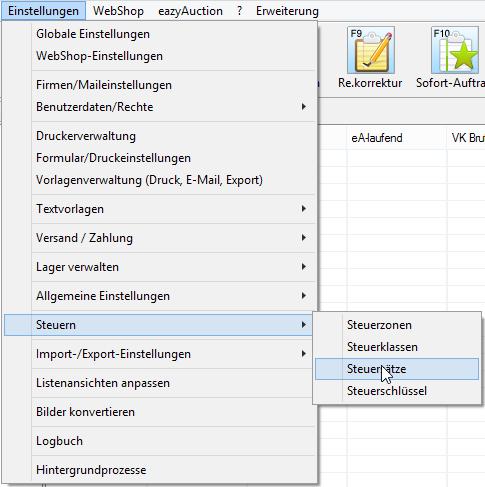

Now we need to adjust the tax zones. We open the necessary window via “Settings → Taxes → Control zones”.

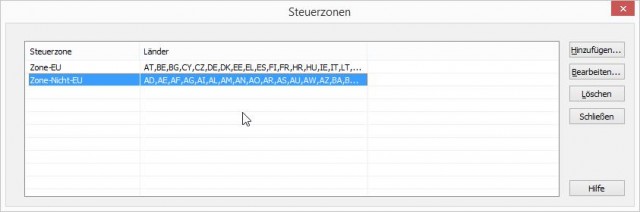

In the Tax Zones window, we need to remove Switzerland from the “Zone-Non-EU” tax zone, since each country can only be in one tax zone. So we mark the tax zone “Zone-Non-EU” and click on the button “Edit…”.

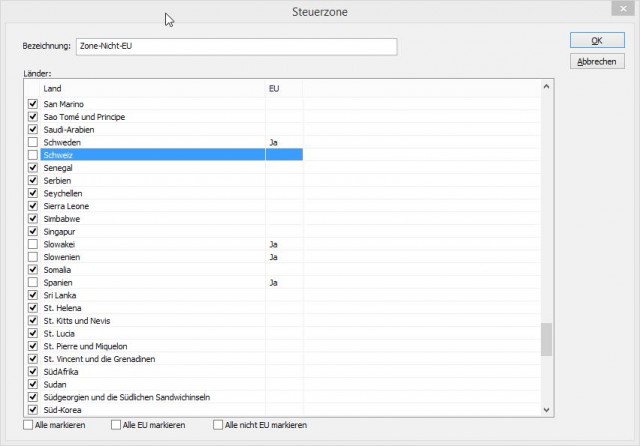

Here we scroll down in the selection field “Countries” until we have Switzerland and remove the checkmark in front of Switzerland. After that we click the “OK” button.

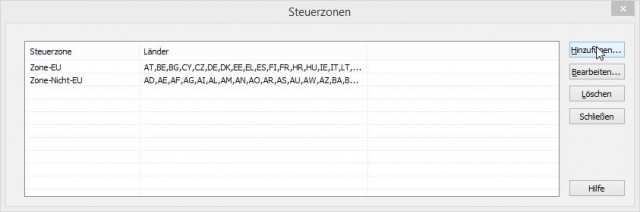

Now we can create a new tax zone for Switzerland by clicking the “Add…” button.

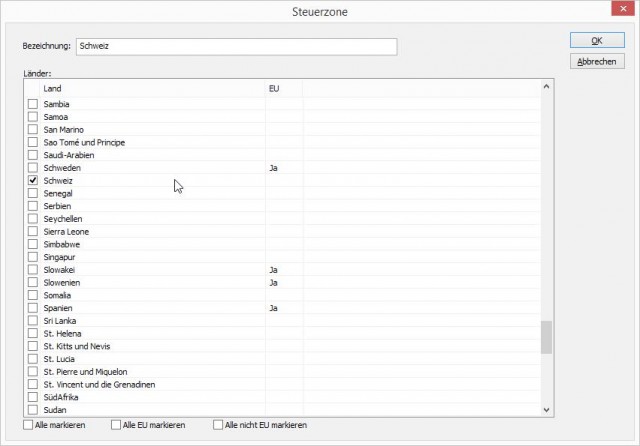

In the Tax Zone window, we enter “Switzerland” under Designation and select Switzerland in the Countries selection box.

Now we can exit the Control Zones window by clicking the “Close” button.

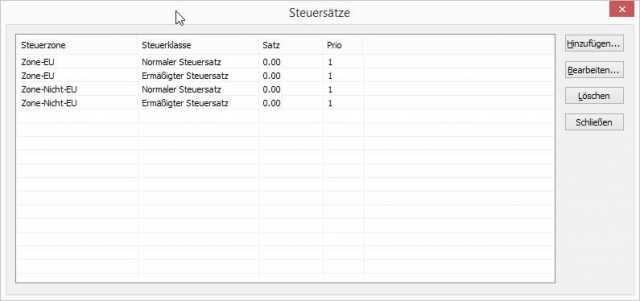

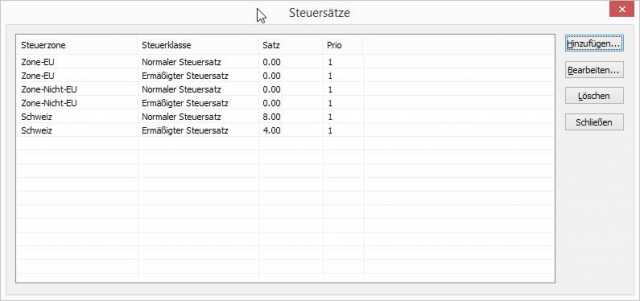

Currency and tax zone are established. What remains are the correct tax rates and the centime rounding. The tax rates are stored in the menu Settings → Taxes → Tax rates.

If tax rates are stored here for the specified tax zones, these must be set to 0.00 via Edit. Afterwards, the normal and reduced tax rates can be created using the “Add…” button.

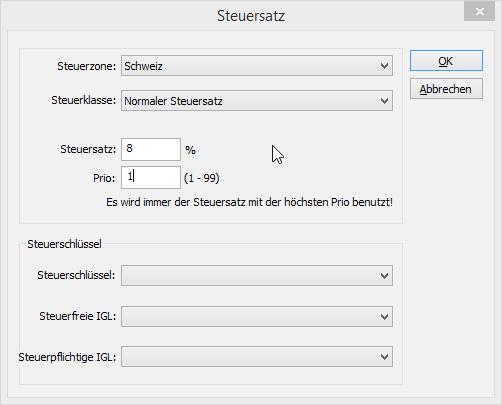

When creating the new tax rates, Switzerland is selected as the tax zone, the corresponding tax class and the percentage value is stored in the Tax rate field. In the Prio field it is sufficient to enter the value 1. In Switzerland, the control keys can be left blank. Then close the window by clicking the “OK” button.

Once the two new tax rates have been created, we can exit the window by clicking on the “Close” button.

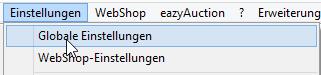

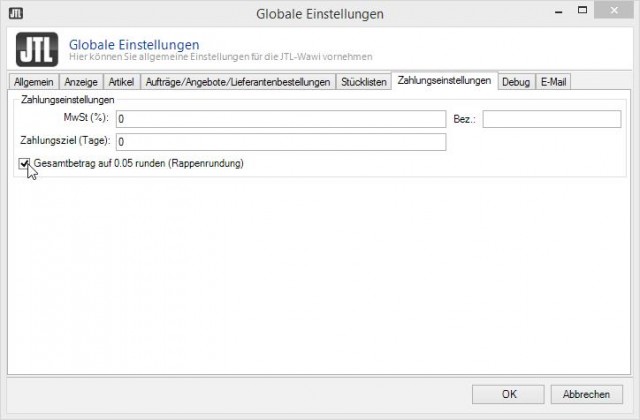

As a last step, we need to adjust the Rappen rounding in the Global Settings in the Settings menu.

In the “Global settings” window we switch to the Payment settings tab and check “Round total amount to 0.05 (centime rounding)”.

Thus, we have made all the basic settings for a company in Switzerland.