Temporary adjustment of the sales tax

The German government has passed an economic stimulus package that also involves a reduction in sales tax. Online retailers will cut sales tax by the end of the year, subject to the approval of the Bundesrat and Bundestag. The regular tax rate will be reduced from 19% to 16% from 01.07.-31.12.2020, and the reduced tax rate from 7% to 5%.

Important! Do the change really only on 01.07. before the first, or on 30.06. after the last invoice through, because the tax rate is adjusted exactly from this time!

How to implement this change in your ERP or store system, you can read here.

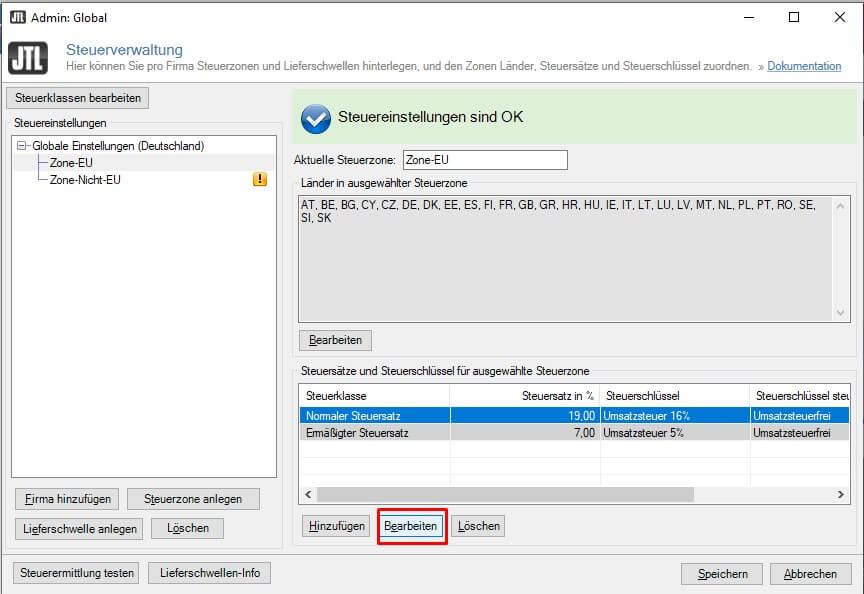

16% sales tax in JTL-Wawi

On 25.06.2020 JTL-Software has released an update for JTL-Wawi. The new version is 1.5.24 and can be downloaded here:

In this new version, an automatic conversion of the sales tax rates is stored.

JTL-Software has created an extensive help page and also deposited some videos. You can find this page here:

JTL software blog on the sales tax change.

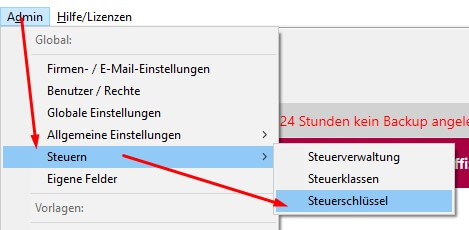

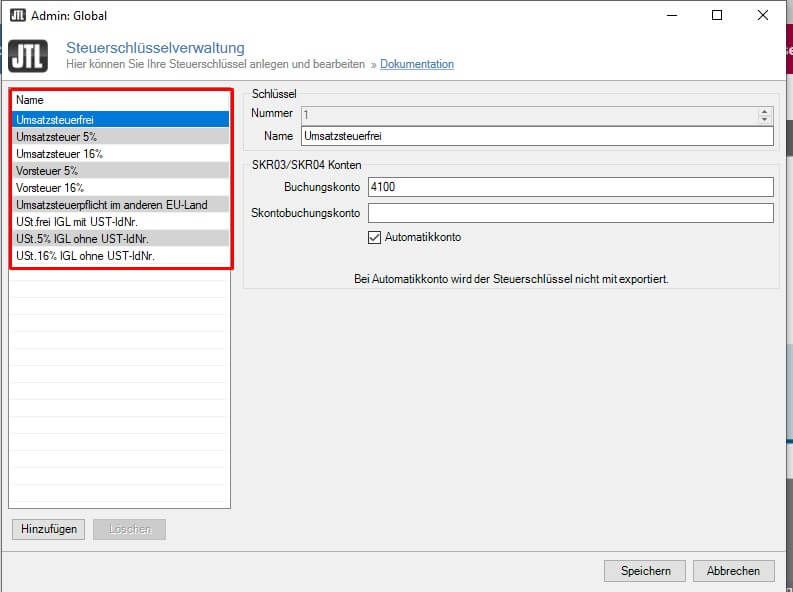

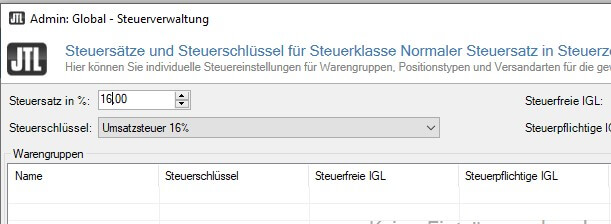

If you want to make the changes manually, this is how to do it:

To adjust only the tax rate click on “Taxes / Tax Key” in the admin menu and change 19% to 16& and 7% to 5% respectively. After saving, click on “Admin / Taxes / Tax administration” and change the tax rates here as well.

This completes the adjustments.

16% sales tax in Xentral

In Xentral you set the tax in the admin area. To do this, go to the “Administration / Settings / Basic settings / Tax/currency” section and simply adjust the tax rates there.

16% sales tax in Afterbuy

Here the solution is very simple. For the cut-off date, go to the “Management Center / Configuration / Settings” menu in Afterbuy and overwrite the respective percentages with the new ones.

16% Sales tax in Vario

Vario has written a very comprehensive article and video on what to consider when making the switch.

Basically, you define in the menu 1.4.4. new sales tax rates. Now you decide whether you want to change the gross or net prices. In B2B, or if you want to pass the change to your B2C customers, you change the calculation base to the net price.

You can find more detailed info and the video here:

https://www.vario-software.de/blog/mehrwertsteuersenkung-2020/

16% sales tax in DESCARTES*pixi

Descartes wrote extensive guidance on how to adjust sales tax rates. You can find this guide here: Economic stimulus package – what will change in pixi

16% sales tax in Shopify

Click on “Settings / Taxes” in the Shopify admin area. In the “Tax regions” section, click on “Germany”. Here you see “Base taxes” – you adjust these rates to the new tax rates.

16% sales tax in Shopware

Shopware is still working on a plugin that should make it easier to change sales tax. If it doesn’t come on time, you can make the changes manually that way – just be careful which prices you adjust. Gross or net.

This way you adjust the gross prices (net prices come below):

Open in the Shopware backend “Settings / Basic settings / Shop settings”.

Here you change the tax rate to the new value. The prices in the store are adjusted automatically.

This is how you change the net prices:

Change the tax rates under “Settings / Basic settings / Shop settings”. Now you have to make an additional change in your database. So you should definitely make a backup in case something goes wrong.

In your database, you run this command if you have only one tax record:

For 19 to 16%:

UPDATE s_articles_prices SET price = price/1.16*1.19

For 7 on 5%:

UPDATE s_articles_prices SET price = price/1.05*1.07

If you also have a B2B store, you can additionally run a check on the customer group, it will look like this for the customer group ‘EK’ (at the end of the formula):

UPDATE s_articles_prices, s_articles SET s_articles_prices.price = s_articles_prices.price/1.16*1.19 WHERE (`s_articles`.id = `s_articles_prices`.articleID AND `s_articles_prices`.pricegroup=’EK’)

Support during the changeover

If the effort is too much for you, or you simply don’t have the time, feel free to contact us. We will make the adjustment to your store and will be happy to check what else can be adjusted to help you achieve higher sales. Why not arrange a free initial consultation right away?

- 0/5

- 0 ratings

| Very bad! | Bad | Hmmm | Oke | Good! |

|---|---|---|---|---|

| 0% | 0% | 0% | 0% | 0% |

Haben Sie Fragen oder brauchen ein individuelles Angebot? Zögern Sie nicht, uns zu kontaktieren.